Seeking investment

Ostara is in a unique position to take ownership of the human fertility pathway with its range of next generation products to improve pregnancy rates

Technology

IP protected

Sector

Fertility

£5 million

Target raise

Ostara is raising £5m to deliver key products to the fertility market and strengthen its ownership of the fertility pathway. Reaching profitability by the end of 2023 and offering the opportunity for significant returns on investment.

Ostara is in a unique position to take ownership of the human fertility pathway with its range of next generation products to improve pregnancy rates.

Ostara is taking ownership of the fertility journey with its pathway of unique and proprietary products, offering end-to-end solutions supported by its digital platform.

The problem

Globally 1 in 6 couples struggle to conceive

- Fragmented market with few cost-effective/ accessible fertility treatment options

- Treatments have low success rates

- Limited access to accurate information with no end to end support

- Little innovation in large areas of the market with few clinically validated products

The opportunity

- Growing consumer awareness of fertility solutions is energising consumer demands

- Targeting the huge potential to repurpose/redesign clinical technology for home use

- Translating products from developed to developing countries

- Rapidly growing Artificial Reproductive Technologies (ART) market (10% CAGR)

- Market forecast $50bn by 2027

Our portfolio

Pipeline: Clinical and home products being targeted for remainder of pathway

Evie™ – Clinical Intra Uterine Insemination (IUI) device that

increases pregnancy by 2.5x (FDA/CE marked

Zoie – Clinical IVF/IUI pessary that primes uterus for enhanced embryo implantation

Digital Platform: Developed to drive Ostara’s product range and pipeline IP: Extensive portfolio of granted patents (US,EU, China, Japan, Singapore, Canada), trademarks and design rights

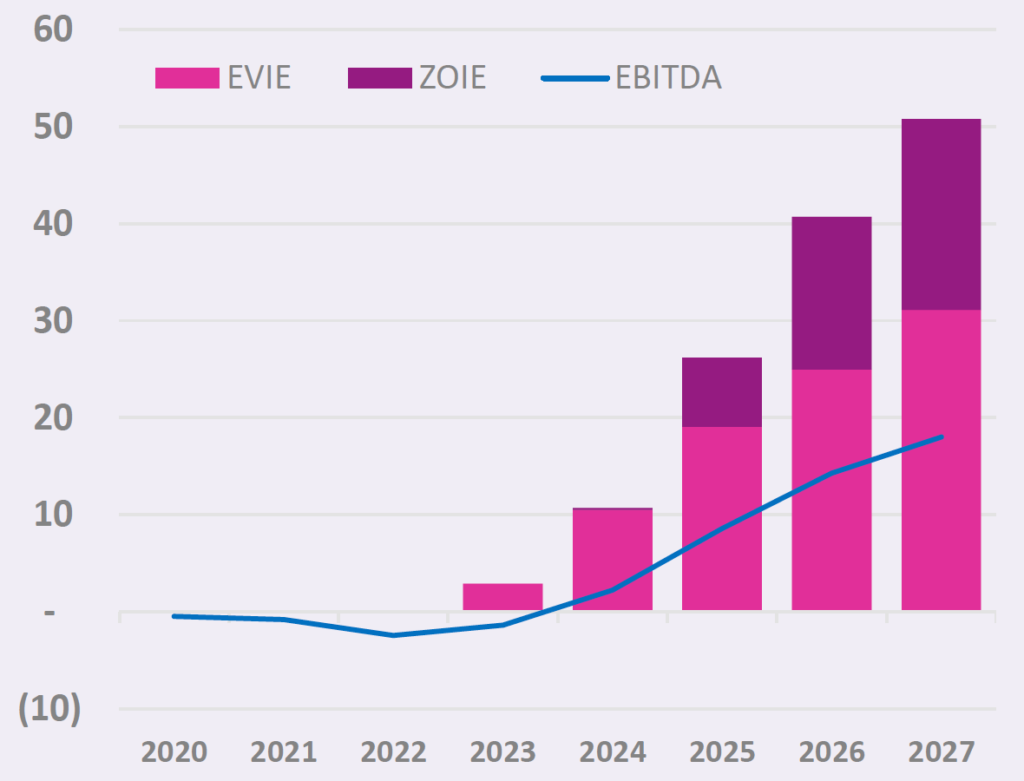

Revenue and EBITDA (£m)

Revenues shown for Evie™ and Zoie, launching in H2 2022 and H2 2024 respectively. These will be complemented by additional products acquired or licensed in 2021, 2022 and follow-on years.

Breakeven is achieved by the end of 2023.

Sales traction is built rapidly via KOL clinic chain partnerships penetrating multiple country clinics. Priority countries include, EU, UK, USA and Asia leveraging current relationships.

To date Ostara has received £1.5m in non-dilutive grant funding from Innovate UK and UK Research Councils

(BBSRC and NC3Rs). Further applications are being made.

| Company | Ostara Biomedical Ltd Liverpool Science Park, Innovation Centre, Liverpool, UK |

| Investment sought | £5m |

| Use of funds | Accelerate completion and launch of Evie™ IUI medical device Drive development and formulation of Zoie (therapy for increasing IVF success rates) for preclinical and regulatory approval Expansion of executive, commercial and operational teams Development of fertility products/services and delivery of Ostara’s digital platform Deliver Key opinion leader clinics and partners in priority markets Expand Ostara portfolio by in-house innovation, product(s) acquisition and licensing Increase IP protection for expanded commercial markets |

| Existing investors | Praetura Ventures LLP North West Fund for Biomedical LP Deepbridge Capital LLP Angel and HNW (EIS investors) |

| Leadership | Dr Nadia Gopichandran, CEO. 20yr+ fertility R&D/entrepreneurial roles John McKinley, Chairman. 30yr+ public/private life sciences leadership Ian Mawhinney, Product Director. 30yrs+ commercialising new MedTech devices Dr Sarah Field, Technical Director. Expert in R&D in mammalian reproduction Richard Smith, CFO. 20+yrs in Life Sciences start-ups to large pharma Dr Nicolas Orsi, Medical/Scientific Advisor. Co-inventor. Extensive experienced in fertility research and commercialisation |

| Forward Investment / Exit Strategy | Ostara is exploring an IPO in a mid-term time frame, however consideration will also be given to exit events by industry and private equity. |

Disclaimer

The content of this communication has not been approved by an authorised person within the meaning of the Financial Services and Markets Act 2000. Reliance on this communication for the purpose of engaging in any investment activity may expose an individual to a significant risk of losing all of the property or other assets invested.